The Santa Anita Park in Arcadia, California is one of the premier racing tracks in the world. In addition to hosting the Breeders’ Cup race, the track also hosted equestrian events during 1984 Olympic Games. It has hosted many famous races. The park offers a variety of betting options.

The hillside turf course is a highlight of the track. This course crosses the main dirt track in a unique way. This allows for shorter sprints and other races over a distance of approximately 6 1/2 furlongs.

The track is owned by the Stronach Group, which also owns Gulfstream Park. It is home to the Pegasus World cup. The Breeders' cup and Santa Anita Derby both are major events at this track. Justify, Winning Colors. Affirmed, Codex, and Codex are some of the most prominent horses in the region.

Santa Anita held 104 races earlier in the year. There are some specialties on the course like the downhill.

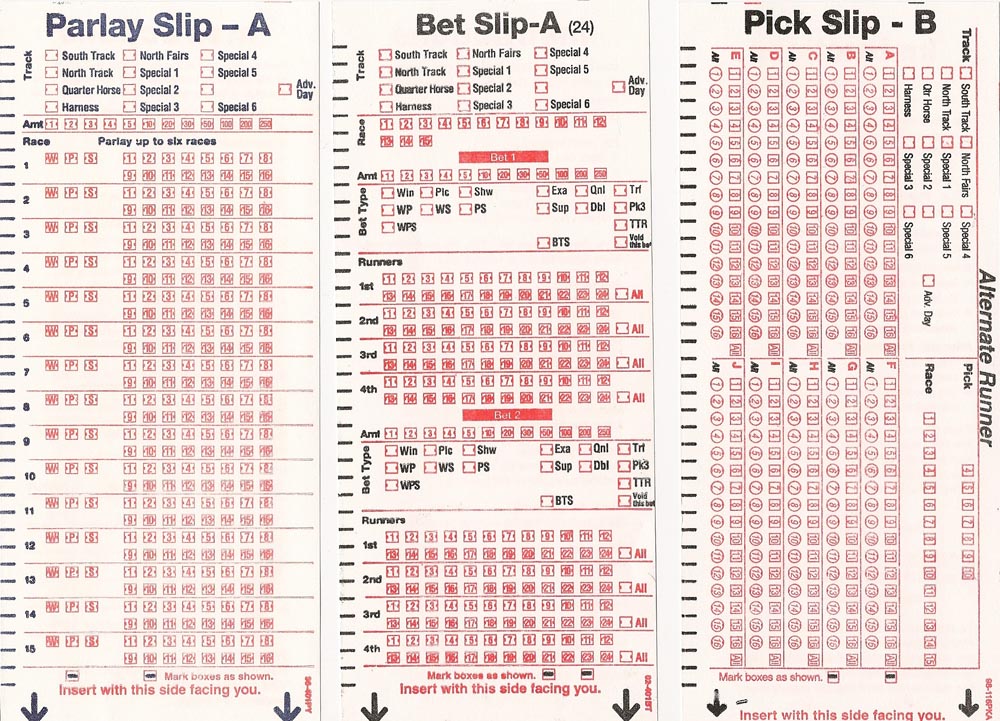

The horse racing is not the only attraction. There are also many restaurants and off-track betting possibilities. Santa Anita is easily accessible by a number of bus routes. From San Diego, the Metro Gold Line makes it easy to get there. You can even rent a private box at the park.

Santa Anita hosted this year's Breeders Cup Championships during its fall meet for the third time. In fact, the track has hosted eight Breeders’ Cup Championships. Flavienprat, a seasoned jockey, will be present at this week's meeting. He's a Frenchman and has a knack to win on both turf or dirt.

Saturday marks the beginning of the winter meet at The Park. It's not as popular, but it's still a great attraction. A handful of Grade 1-favorites will be featured on the card, including Omaha Beach and I'll Have Another.

The Santa Anita Derby makes up part of the Road to the Kentucky Derby. It's a $1million race. Since it started in 1935, the race has produced eight winners that eventually went on to win the Kentucky Derby. The Derby favoritism often favors the winners of the race.

Santa Anita Park offers the best handicapping services in the state. Jeff Siegel, the horse owner and expert handicapper, is responsible for this site. His Xpressbet site offers a variety of bets, as well as updates and analysis on the latest races.

Santa Anita is a main venue for thoroughbred racing. The track has seen some changes in its history, but it remains a top destination in the US. The park is located near Los Angeles and remains a top choice. The park offers many options for enjoying the excitement of racing.

FAQ

What is the difference between passive income and active income?

Passive income is when you make money without having to do any work. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. This could include selling products online or creating ebooks.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

Problem is, passive income won't last forever. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. It's better to get started now than later. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are 3 types of passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

What side hustles are most lucrative in 2022?

The best way today to make money is to create value in the lives of others. This will bring you the most money if done well.

It may seem strange, but your creations of value have been going on since the day you were born. When you were a baby, you sucked your mommy's breast milk and she gave you life. Learning to walk gave you a better life.

As long as you continue to give value to those around you, you'll keep making more. The truth is that the more you give, you will receive more.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

Today, Earth is home for nearly 7 million people. That means that each person is creating a staggering amount of value daily. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. That's a huge increase in your earning potential than what you get from working full-time.

Let's imagine you wanted to make that number double. Let's suppose you find 20 ways to increase $200 each month in someone's life. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

There are millions of opportunities to create value every single day. This includes selling products, ideas, services, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. Start by downloading my free guide, How to Create Value and Get Paid for It.

How much debt is too much?

It's essential to keep in mind that there is such a thing as too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much should you live with? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. That way, you won't go broke even after years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 Spend no more than $5,000 a month if you have $50,000.

The key here is to pay off debts as quickly as possible. This includes student loans, credit cards, car payments, and student loans. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. Over five years, that would add up to $500. After six years, you would have $1,000 saved. In eight years, your savings would be close to $3,000 You'd have close to $13,000 saved by the time you hit ten years.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. Now that's quite impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

It's crucial to learn how you can manage your finances effectively. You might end up with more money than you expected.

What is the easiest passive source of income?

There are many ways to make money online. However, most of these require more effort and time than you might think. So how do you create an easy way for yourself to earn extra cash?

You need to find what you love. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

As another source of passive income, you might also consider starting your own blog. It's important to choose a topic you are passionate about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

While there are many options for making money online, the most effective ones are the easiest. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once you have created your website, share it on social media such as Facebook and Twitter. This is content marketing. It's an excellent way to bring traffic back to your website.

Why is personal finances important?

If you want to be successful, personal financial management is a must-have skill. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why do we put off saving money? Is it not better to use our time or energy on something else?

Both yes and no. Yes, because most people feel guilty if they save money. Yes, but the more you make, the more you can invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Financial success requires you to manage your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Unrealistic expectations may also be a factor in how much you will end up with. This is because your financial management skills are not up to par.

After mastering these skills, it's time to learn how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

You must then figure out how you can convert leads into customers. To keep clients happy, you must be proficient in customer service.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

It takes a lot of work to become a millionaire. A billionaire requires even more work. Why? You must first become a thousandaire in order to be a millionaire.

Then you must become a millionaire. Finally, you must become a billionaire. The same goes for becoming a billionaire.

How does one become a billionaire, you ask? You must first be a millionaire. You only need to begin making money in order to reach this goal.

You must first get started before you can make money. Let's discuss how to get started.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

For cash flow improvement, passive income ideas

There are ways to make money online without having to do any hard work. Instead, there are passive income options that you can use from home.

You may already have an existing business that could benefit from automation. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

The more automated your business, the more efficient it will be. This allows you more time to grow your business, rather than run it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows you and your company to concentrate on what is most important. By outsourcing a task, you are effectively delegating it to someone else.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

Another option is to turn your hobby into a side hustle. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

For example, if you enjoy writing, why not write articles? You have many options for publishing your articles. These sites allow you to earn additional monthly cash because they pay per article.

It is possible to create videos. Many platforms allow you to upload videos to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

One last way to make money is to invest in stocks and shares. Stocks and shares are similar to real estate investments. Instead of receiving rent, dividends are earned.

You receive shares as part of your dividend, when you buy shares. The amount of dividend you receive depends on the stock you have.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. This will ensure that you continue to receive dividends.